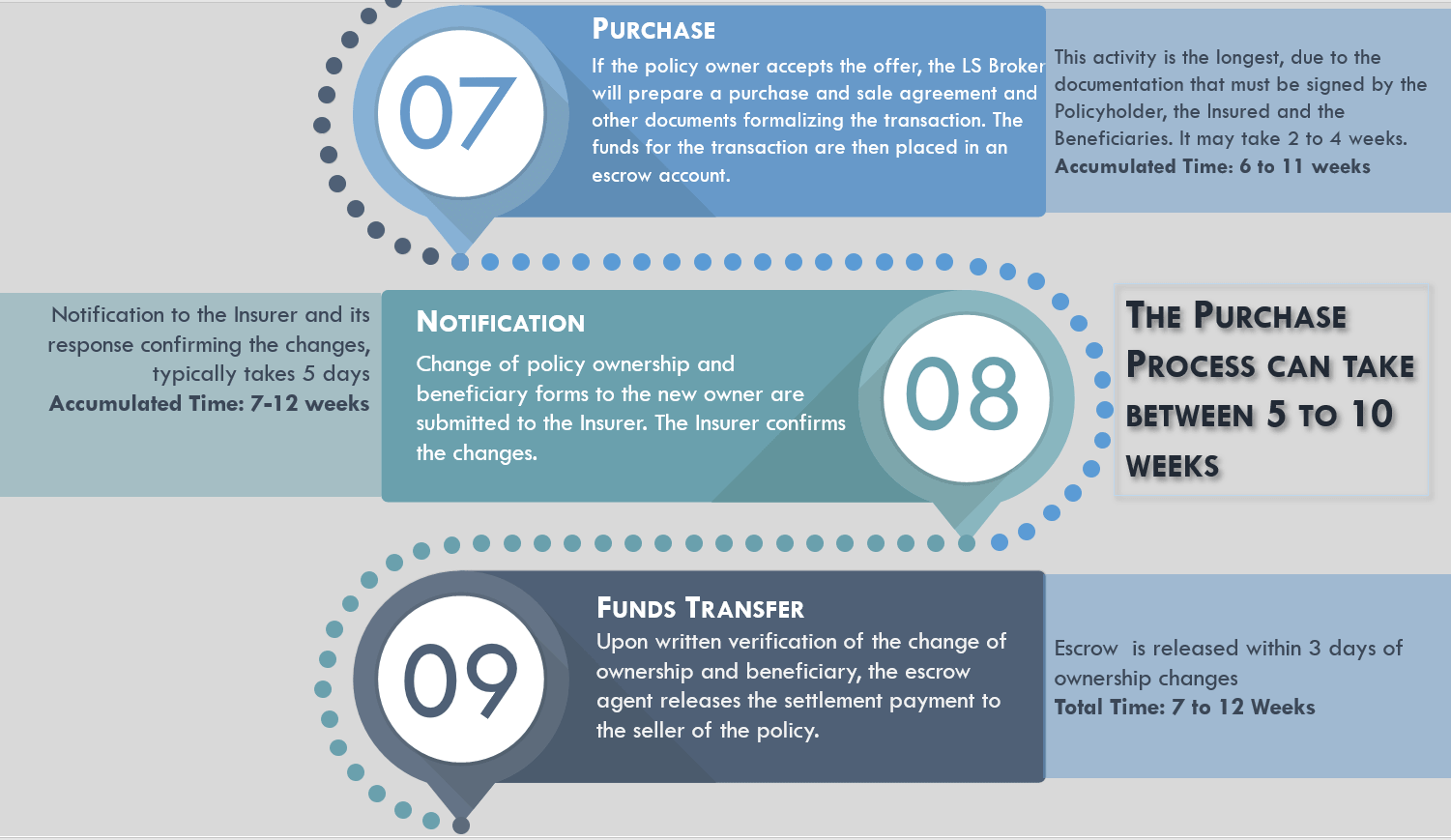

Closing Process

Once an offer is accepted by the policy owner the Closing Process begins. Contracts, including disclosures, authorizations and releases, are generated by a closing firm (typically a provider) to be signed. Parties that must sign contracts include:

- Policy Owner (individual, trustee, authorized representative)

- Insured

- Beneficiary (individual, trustee, authorized representative)

- Spouse (if applicable)

Getting contracts signed & notarized can take longer depending on how fast the signing parties handle contract completion. Once contracts are signed and returned to the closing firm the contracts and supporting documents are reviewed. If everything is in order the investor must place the purchase funds in escrow.

After escrow confirms funds are received, the investor is provided the insurer change forms (already signed by the policy owner) to sign. These signed ownership & beneficiary change forms are then submitted to the life insurance carrier for processing.

Within three (3) business days of insurer confirmation letters being received showing the ownership & beneficiary have changed, the policy owner (seller) is funded. Depending on the state, the seller may have a recision period to back out of the transaction. Once that recision period is over the remaining escrow amount is released to pay for closing fees, broker commissions and referral fees.

After escrow confirms funds are received, the investor is provided the insurer change forms (already signed by the policy owner) to sign. These signed ownership & beneficiary change forms are then submitted to the life insurance carrier for processing.

Within three (3) business days of insurer confirmation letters being received showing the ownership & beneficiary have changed, the policy owner (seller) is funded. Depending on the state, the seller may have a recision period to back out of the transaction. Once that recision period is over the remaining escrow amount is released to pay for closing fees, broker commissions and referral fees.