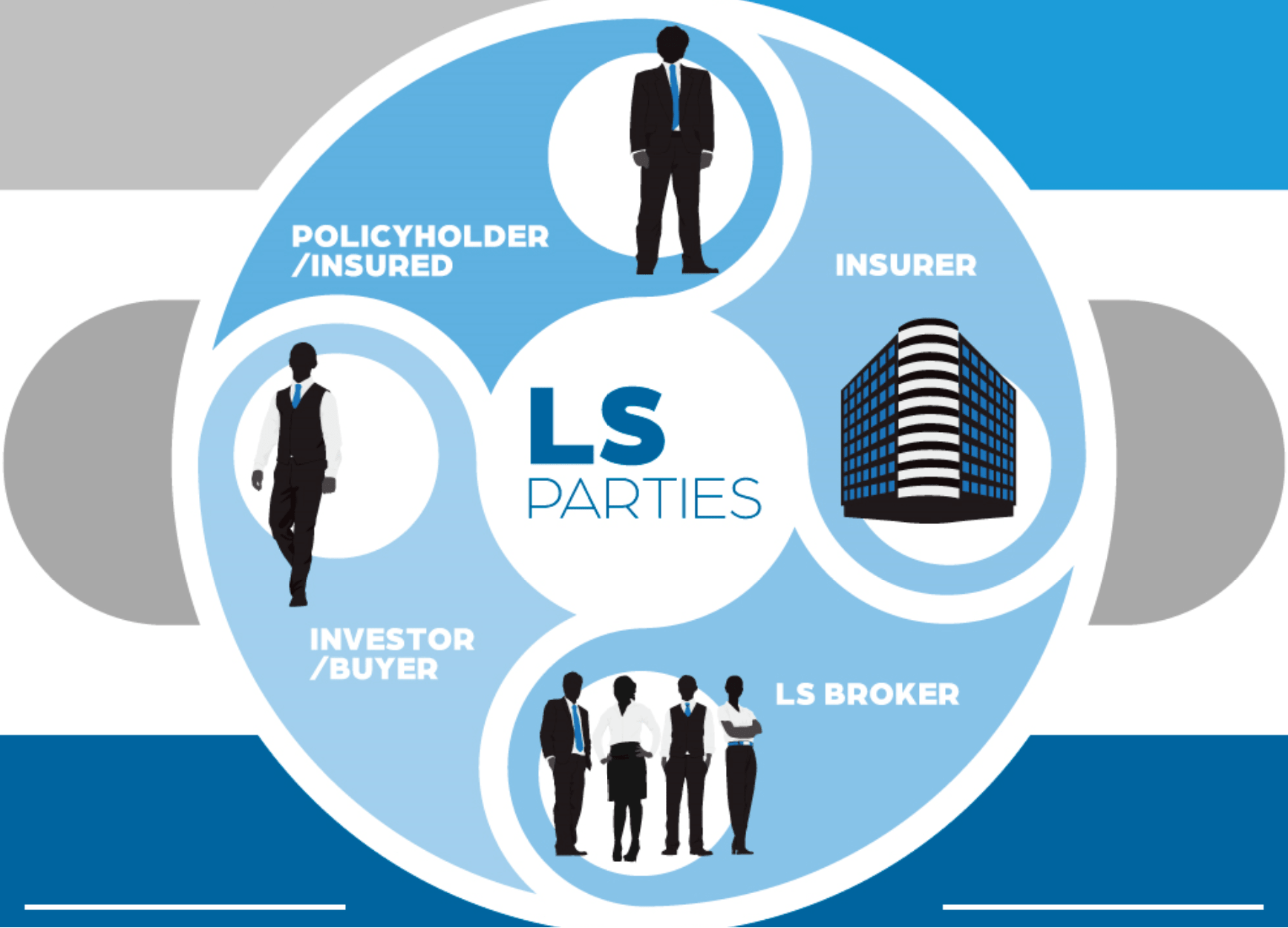

The life settlement process involves several parties that work together to complete a life settlement transaction. The steps involved in the life settlement process, and the interactions between parties, will be addressed later in this course. The primary life settlement parties include:

- Policy Owner / Insured - This is the owner and insured of the existing life insurance policy that are pursuing a life settlement offer. They can work with a life settlement broker or a provider/investor direct to obtain an offer for their policy. Lacking a wide network of buyers and industry experience better offers are almost always obtained by working with a life settlement broker.

- Insurer - This is the life insurance carrier that originally issued the life insurance policy. During the life settlement process the life insurance carrier is contacted to provide policy values, illustrations and to process ownership & beneficiary designation changes if transaction closes. Over time, life insurance carriers may be acquired by other life insurance carriers, so the original insurer may now go by another name. For example, West Coast Life Insurance Company policies are now owned and managed by Protective Life Insurance Company.

- Life Settlement Broker - This life settlement intermediary assists policy owners, and financial professionals with life settlement leads, through the life settlement process. A life settlement broker will cover expenses, manage the gathering of all required information, distribute completed cases to a wide network of buyers and manage the offer and closing steps. Since brokers work with a wide range of buyers they ensure policy owners and financial professionals maximize every opportunity.

- Investor / Buyer / Provider - These life settlement parties are the end purchasers of life settlement policies. They evaluate insured health and policy future premium payments to determine pricing and make offers. Often times, the companies advertising directly to policy holders and financial professionals for life settlement cases are Providers. The downside of submitting cases directly to a Provider is they will try to purchase a policy for as little as possible instead of making the market compete like a life settlement broker.