Reasons for Life Settlement

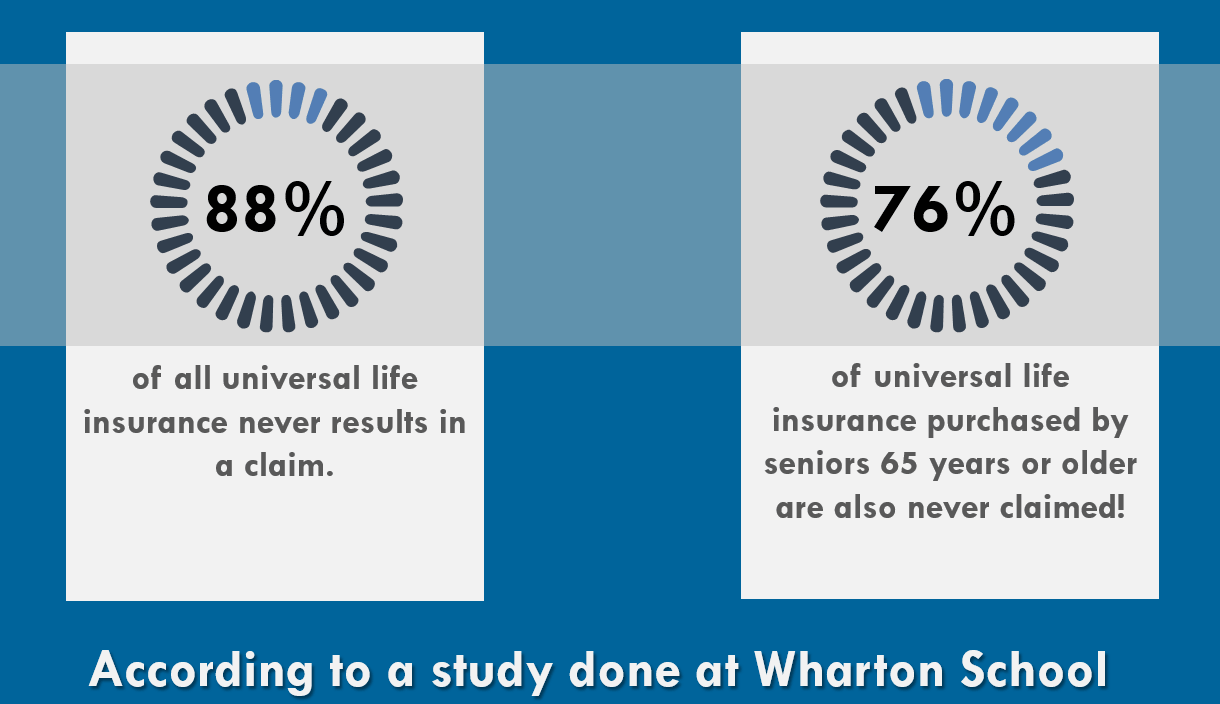

The life settlement option is pursued for a variety of reasons. Why someone with an existing life insurance policy would sell their policy can be unbelievable until the policy lapse rate data is considered. Life insurance carriers figure around a 90% policy lapse rate when pricing life insurance products. This means life insurance carriers expect the majority of life insurance policies to lapse. As a policy owner, lapsing a life insurance policy returns zero value unless there is a cash surrender value. Either way, if possible, a life settlement will provide more value.